Drop in income in the third-quarter of 2017 is still impacting reinsurers in Africa notwithstanding growth in written premiums recorded by a firm like African Reinsurance Corporation in the first quarter of 2018. Many of the firms were yet to update their websites concerning their written premiums of the first quarter of 2018, a sign that all is not well. This affirms experts’ worry that Africa’s $6.8bn reinsurance market will decline this year, given that many insurance firms’ net income in the first three months of 2017, waned by 73.61 per cent to N604.56 million in contrast with N2.29 billion that was the case in March 2016. Again, by December 2017, their net income dropped by 20.57 percent to N2.47 billion as against N3.11 billion in 2016, writes Odimegwu Onwumere, winner of the 2018 Continental Re’s Pan African Journalist of the Year award

Despite the growth in written premium recorded by few reinsurance firms in Africa in the first quarter of 2018, the predictions by professionals that insurance markets in Africa would be defectively punched by rising reinsurance cost this year, holds water.

While a firm like the African Re said it recorded a gross written premium of 26.31%, from US$ 167.13 million in March 2017 to US$ 211.10 million in 2018, the record does not represent what reinsurance firms on the continent are going through.

The inspiring performance made by Africa Re revealed the flourishing 1 January renewals in most of its markets – the South African reinsurance market had some difficulties.

Opinion leaders stated that in spite the increase in premium made by African Re, unfavourable claims occurrence with numerous huge and misfortune losses, piloted to an approximately break-even underwriting outcome.

The trade tariff disagreement between China and the US, joined with an increase in the US Federal Reserve interest rates, saw to more problems in the international financial markets in the first quarter of 2018.

According to a statement by Corneille Karekezi, Africa Re’s GMD/CEO, many of the financial markets endured a modification during the period under review. Hence, Africa Re’s investment earnings dropped to US$ 3.34million from US$ 13.97 million which was gained in the first quarter of 2017.

Notwithstanding, the corporation didn’t sleep on its oars but exhibited hardiness not minding the key losses it testified in 2017 and impacting 2018.

Natural and economic catastrophe

The battle-to-survive in business among the reinsurance firms on the continent was due to natural and economic catastrophe in many parts of the world last year.

As at May 2018, Continental Reinsurance Plc, an amalgamated reinsurer, writing business in more than 50 countries across the African continent had not updated its Q3 2018 record, a habit showcasing that all might not be well with its written premiums for the year.

The 19 March, 2018 press release by Continental Re revealed its full year results for the year ending 31 December 2017. In that statement, the firm said: “Throughout 2017, the African insurance market continued to experience the residual effects of prior years’ business turbulence stemming from the sharp slowdown of key economies impacted by the widespread foreign exchange crunch arising from low commodity prices.”

The fall in premiums was applicable to some other firms. Explaining, the group managing director of Continental Re, Dr. Femi Oyetunji said, “2017 represents yet another year characterized by headwinds emanating from the challenging economic environment.”

“Localized volatility and periodic downturns are inherent features of doing business in Africa,” he added.

Prediction of 2017

The maintenance of reinsurers’ outlook was at negative in 2017, whereas they had hoped that the overall market circumstances recover somewhat over the near term.

They did this because of the significant vagueness surrounding the level and continuity of any enhancement in the reinsurance market’s environment.

African insurers, but especially Nigerian insurers, operated in a depleted business environment and there was poor turnout of business in the third-quarter of 2017.

Conversely, reinsurers on the continent hoped that Africa’s $6.8bn reinsurance market would recover in 2018, yet experts in the industry anticipated a rough market.

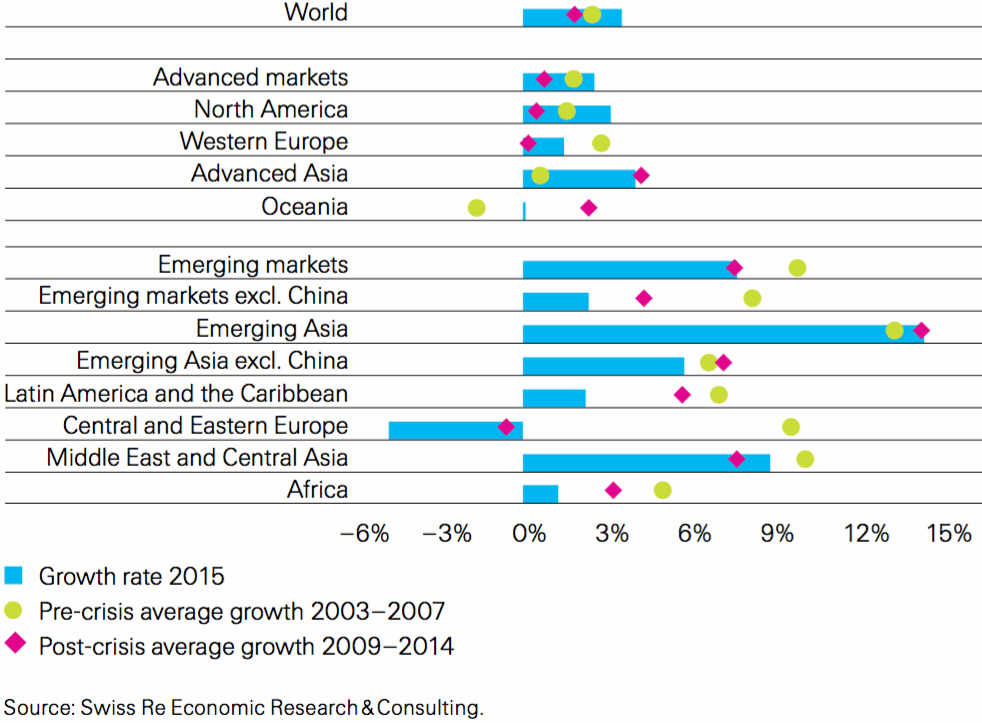

The prediction of 2017 saying that the 2018 would be a rough ride for reinsurers on the continent was based by specialists on the drop to 1.8% in GDP growth, below the global average of 2.5%.

They talked about insurance premiums that dropped by 5.3% translating to US$ 61 billion in 2017.

They gasped over the reduction, which experts said was chiefly because of decrease of some key African currencies against the US dollar.

They knew that the insurance sector couldn’t help Africa to both address energy poverty and to give shelter to its population without gains in insurance premiums.

Private sector financing

Insurance sector not being able to help Africa to both address energy poverty and to give shelter to its population, was contrary to what reinsurers discussed at the UN Financing for Development Conference in Addis Ababa, when experts met to discuss development issues in Africa and the role of private sector financing.

They wanted to carve a niche and help the more than 620 million sub-Saharan Africans who lack basic access to electricity, but unfortunately, premiums declined.

The reinsurers believed it would be powerful to help the sub-Saharan Africa in this era of climate change, but they started to experience decline in premiums.

Declining net premium

At the 22nd African Reinsurance Forum in Mauritius last October, Africa’s reinsurance executives were hopeful about the predictions of their markets in 2018.

But many of the insurance firms’ net income in the first three months of 2017, waned by 73.61 per cent to N604.56 million in contrast to N2.29 billion that was the case in March 2016.

Experts bemoaned that spiky slump “at the top-lines (profit)” was because there was 1016.61 per cent deterioration in reinsurance everyday expenditure to N911.70 million and an 82.63 per cent diminution in unjustified income to N2.56 billion in-spite-of an “uptick in written gross premium.”

Buttressing this, data has it that analysis of the financial declaration of NEM Insurance Plc, Nigeria, demonstrated gross premium written (GPW) augmented by 29.17 per cent to N5.18 billion in March 2017, whereas net premium income bowl-shaped by 32.41 per cent to N1.71 billion.

Investigation revealed that like other re/insurance firms experienced, NEM paid a total of N439.90 million in March 2017, which signified a 66.60 per cent drop in premiums from last year’s numeral of N1.31 billion the preceding year.

The data explained that the Nigerian insurer underwriting everyday-expenditure was 43.15 per cent to N885.63 million in the time under assessment from N618.66 million as at March 2016.

What reinsurance faced

Some of the continent’s reinsurance expenses (as a portion of written gross premium) climbed to 49.23 per cent in March 2017 from 34.91 per cent as at March 2016.

But a firm like NEM, its underwriting profit dropped by 51.85 per cent to N1.56 billion in the time under review as opposed to N3.24 billion as at March 2016.

It was noted that reinsurance firms in Africa were faced with rising inflation, weak money and an economic recession.

There were under-performance and lack of market piercing products, weak regulatory strategy, shallow enlightenment and public lackadaisical approach towards insurance.

These, experts said were the reasons stock price in a country like Nigeria hadn’t moved beyond 2Naira in five years preceding 2017. They added that this incessantly undermined growth.

Shortage of foreign exchange

Reinsurers on the continent but especially in Nigeria were forced to retain risks emanating from the local market higher than their capacity due to shortage of foreign exchange (FX) needed to transact international businesses that happened.

It started in 2016 and analysts had opined, “Insurance industry is sitting on a gun powder waiting to explode, as inflation adjusted claims are huge and coming in their numbers, and this is capable of weighing down the industry.”

The managing director/CEO, Risk Analysts Insurance Brokers, Funmi Babington-Ashaye, who confirmed the impact of shortage of FX policy on the industry, said insurance companies could not get FX to repatriate for reinsurance and so have resulted in keeping some of the risks locally.

Devaluation of the currency

Re/insurers in a country like Nigeria had not predicted that there would be a drop in foreign exchange unlike in the mid 2016 when the devaluation of the currency by the Central Bank of Nigeria (CBN), was a huge blessing to them and boosted their profit that year.

Despite that targeted underwriting actions by Continental Re yielded fruits with flooding of 211.59 percent to N1.29 billion as at December 2017, many believed that reinsurers spent more on claims than they gained in premiums.

Juxtaposing to this, those who know better stated that Nigeria’s GDP had a drift of 0.52 per cent sliding in 2016. As according to data from the National Bureau of Statistics (NBS), this shift was Nigeria’s first recession in 25 years.

When the going was good – an example

It was ‘Hosanna in the Highest’ back in 2016 for the Continental Reinsurance Plc (being one of the two licensed reinsurance firms operating in Nigeria; the other is Nigeria Reinsurance Corporation (Nig Re).

Continental Re made 16% growth in gross premium income of N17.5billion in its Q3 2016, as against N15.1 billion in 2015. And as at December 31, 2016, the company told the world through its (audited financial statements for the year ended December 31, 2016 submitted for investors at the Nigerian Stock Exchange (NSE), that total unclaimed dividends it made was N334.032million as against 2015 level of N173.784million, an increase of about 92.2percent within one year.

The records showed “The total amount in the account as at December 31st, 2016 was N385.489million (Interest income from 2011 to date: N128.285million).”

Looking at Continental Reinsurance Plc, its consolidated statement of profit or loss and other all-inclusive income for the year ended December 31, 2016, its gross premium written rose to N22.406billion from N19.738billion in 2015.

Its underwriting expenses increased to N10.498billion from N7.386billion in 2015. Underwriting profit stood lower at N414.549million in 2016, from a record high of N2.055billion in 2015.

Continental Re’s interest income enlarged to N1.5billion from N1.120billion in 2015. Foreign exchange (FX) gain was N4.067billion, an extraordinary rise from N467.981million in 2015.

Then-again, profit before income tax moved to N4.651billion from N2.915billion in 2015.

Continental Re accounted earnings for the year in review stood at N3.118billion from N2.142billion in 2015. Proceeds per share Basic and Diluted (kobo) increased to 28kobo from 19kobo in 2015.

By December 2017, the “Hosanna in the Highest” changed: Continental Re’s net income dropped by 20.57 percent to N2.47 billion as against N3.11 billion in 2016.

Analysts cried out that the decline in foreign exchange was the culprit responsible for the bowl-shape in the Continental Re’s loss.

The wane in foreign exchange was given at 71.92 percent demur (in foreign exchange gains) to N1.14 billion in the cycle under evaluation.

According to opinion leaders, “While Continental Re has an efficient underwriting capacity amid a tough and unpredictable macroeconomic environment; its N0.50 share price is lower than the N1.92 share price of small and midsized lender, Diamond Bank.”

This was around December 2017 and “investors are becoming increasingly worried about the continued stagnation of insurance stocks on the floor of the ‘bourse’ as they have called on regulators to find a way to formulate policies that would invigorate these firms”.

Odimegwu Onwumere is a multiple awards-winning journalist based in Rivers State. Tel: +2348032552855. Email: [email protected]